Home Buyer's Guide

Mortgage Calculators

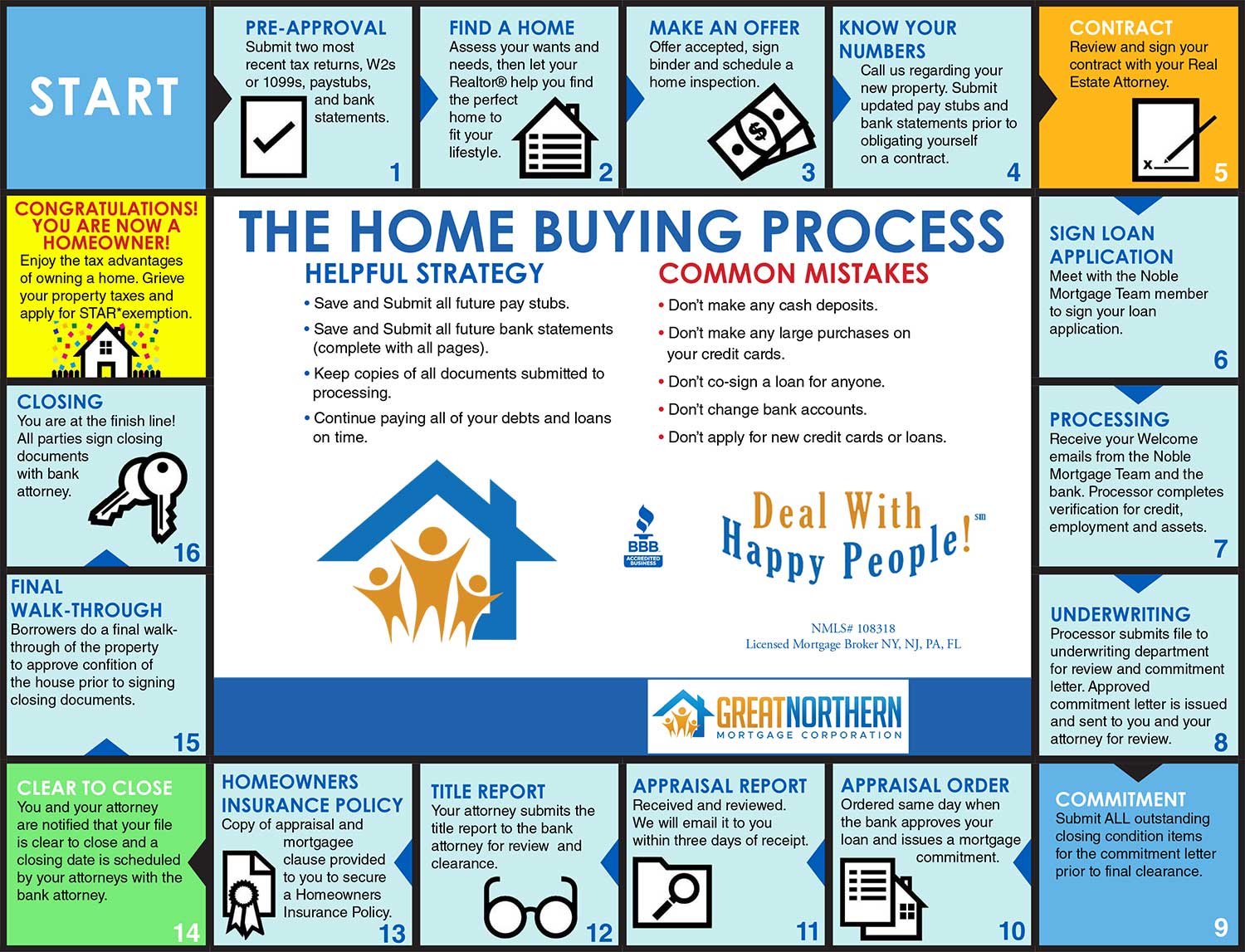

EXPLORE MY OPTIONSBuying your first home can be intimidating, but with our handy home buyer's guide we hope to make the process as simple for you as possible and help guide you through every step. First-time buyers, luxury home shoppers and real estate investors alike can rely on Great Northern Mortgage for guidance through the entire process.

Buying a Home, Step by Step

Before you begin the loan process, it's time to do some research, and by getting pre-approved. You can fill out our pre-approval form online and one of our loan officers will contact you promptly.

Pre-Approval

What does it mean to be pre-approved?

When you are pre-approved, the loan consultant is determining your ability to repay a loan based on provided information. Your debts, assets, and income are reviewed by a loan consultant to establish the maximum purchase price you can afford and how much you'll be able to borrow. A pre-approval often gives you an advantage over other potential buyers when you are house hunting because it demonstrates that you are ready to move forward with the purchase process and that a deal with you is more likely to proceed smoothly.

Pre-qualification

Pre-qualification does not determine your ability to take a loan. When you are pre-qualified, versus pre-approved, the loan consultant most often pulls your credit, takes the loan application over the phone but does not review all necessary financial documents.

Should I be pre-approved now?

By being pre-approved, sellers will take you more seriously when you're looking at real estate -- something which can give you an advantage over other potential buyers looking at the same houses. It'll also help you narrow down your search by establishing your maximum purchase price.

Credit and You

There are many factors that determine what you'll be able to qualify for in terms of a loan, and your credit score plays an important part because it demonstrates your ability to meet your financial obligations. There are a few things you can do to get your credit in order.

Check your credit score prior to meeting with lenders.

You want to make sure your credit score is accurate before you apply for a loan. Annualcreditreport.com will give you a free credit report once a year and this is a good way to check your credit score.

Check for inaccuracies in your credit report.

If you find any inaccurate items in your credit report, you'll want to resolve them before applying for a loan. Any disputes which are in progress can delay loan approval.

Pay down your credit balances to potentially improve your score.

A better ratio of debt to available credit can improve your credit score, so if you have any high credit card balances, pay them down. However, don't close accounts after paying them off! Available unused credit increases your credit score.

Set up payment plans.

If you have any delinquent accounts, speak with your creditors and try to set up a payment plan. Try to work out a plan that doesn't badly disrupt your debt-to-income ratio, but still demonstrates to lenders your ability and willingness to meet your financial obligations.

Meet With Your Loan Consultant

Your Great Northern Mortgage loan consultant will work with you to discuss your needs and help you get started in the loan process. We'll help you determine which loan product is right for you. If you'd like to do some research on your own, you can refer to our breakdown of different loan types.

Take a Look at Your Expenses

You can use our online calculator to get a general estimate of how much home you can afford. Determine how much you can spend on a home, what your monthly mortgage payments could be, how much of down payment you can put down, and more. Your loan consultant will help you determine your budget, including:

- Monthly bills

- Anticipated property taxes

- Estimated insurance costs

- Private mortgage insurance (PMI), if necessary

- Living expenses

- HOA fees, if applicable

Additionally, your loan consultant will help you budget for costs that arise during the buying process, including down payments and closing costs.

Loan Approval

Loan approval is a written commitment from a lender to give you a mortgage for a specific amount over a specific period of time.

To be approved, your information is reviewed and verified by an underwriter, including analysis of your financial information and credit.

Choose a Realtor

Choosing the right realtor is just as important as finding a good mortgage broker. This needs to be someone you can trust. You may want to get a referral from family, a friend, or a trusted professional so that you can be sure you're working with someone reputable and with a track record of success.

We recommend not working with dual agents.

A dual agent represents both the buyer and the seller in a real estate transaction. Their position gives them the opportunity to easily negotiate a deal which is more to their benefit than yours as a buyer, so if you are going to deal with a dual agent, be sure it is someone completely trustworthy.

Don't choose the first agent you speak to!

You should speak with a few agents and ask them some questions so you can compare them with each other and decide who will work best for you:

- How long have you been in real estate?

- Is this your only line of work?

- Are you familiar with the area I'm looking in?

- Have you sold any homes in this area? How many?

- How many homes have you sold in the past year?

- Will you attend the closing of my loan?

Search for a Home

This is the fun part! Now that you have a mortgage broker and a realtor, you can start looking at houses. While you may have a wishlist of features in mind when you start house hunting, there are some key aspects you'll want to keep in mind

Location

The only thing you can't change about a house is its location. Pay close attention to the area. How is the school district? Are there problems with crime? If you commute to work by car, how close are you to major highways? If the location of the home is unsuitable, strongly consider looking elsewhere.

Do not overlook the condition of the house

When looking at a home, it might be easy to get distracted by the things you like about it. But it pays to make note of the details. Determine the age of the roof and the furnace. Look out for signs of potential trouble. You may think a fixer-upper will be a good bargain, but be sure to have a very solid grasp of the repair costs before you decide to purchase one. You may ultimately spend less money on a house that's move-in ready.

Make Your Offer

Before you present an offer to the seller, consider these factors:

- The seller's asking price

- Recent sales of comparable properties in the area

- The overall real estate market

- Potential resale value of the home in the future

- The neighborhood and its amenities

- Condition of the home

- How much competition you have in the form of other interested buyers

- Whether or not you are considering any other homes

After Your Offer is Accepted

Clarify when your seller intends to move out. If the seller continues to live on the property after your closing date, you are entitled to rent payments.

Start The Loan Process

At this stage, it is time to meet with your loan originator to make sure that all of your paperwork is in order so that you can formally submit your mortgage application.

Provide all necessary documentation

Identity and Income Information

- Full legal name, SSN, DOB. You may need to provide a copy of your Social Security card

- Phone number, email address, and residential mailing addresses for the past two years

- Primary and secondary income sources

- Government-issued photographic ID

- Employer names, addresses and phone numbers for the past two years

- Values of your bank accounts, retirement accounts, and investments

- Debt obligations

- Address of the property to be purchased, the year it was built, estimated down payment and purchase price

- Estimates of property taxes, insurance and HOA fees (if any) for the property to be purchased

(Income Information for Self-Employed Borrowers)

- Personal and business federal tax returns for the past three years

- Year-to-date profit and loss statement

- Complete list of all business debts

Credit Information

- Letter of explanation for any late payments, judgments, collections or other derogatory items

- Documentation for any large deposits reflected on bank or asset statements

- Court orders related to any obligations from legal actions

- Bankruptcy/discharge papers for all bankruptcies in your credit history

- Payment histories for utilities, phone bills, auto insurance, and other accounts

Income & Tax Documentation

- IRS Form 4506-T (completed, signed & dated)

- W-2s for the past two years

- Pay Stubs from past 30 days

- Federal tax returns for the past two years (1040s)

- Written explanations for recent changes in employment or employment gaps

- Purchase contract for the property signed by all parties

- Homeowners insurance documentation, including the agent's name and phone number.

By having all these documents prepared, you can greatly shorten the application process and avoid potential roadblocks.

Submit your application

Fill out and sign form 1003 (the residential loan application), including the fair lending notice, loan info sheet and credit authorization.

Review your Loan Estimate

The lender will provide this to you within 3 business days of receiving your application. It contains details about your loan including estimated interest rates, monthly payments, closing costs, taxes, insurance and prepayment penalties.

Clear Requests from Underwriter

The underwriter reviews your documentation to assess if you qualify for the loan you've applied for. They determine the terms of the loan. They may ask for additional documentation to clarify questions that arise from what you have already provided. It's important to respond to these requests promptly and as thoroughly as possible.

Review your Closing Disclosure

The lender will provide this to you at least three business days before your closing. It contains the final terms of your loan. Review it thoroughly and compare it to the estimate you've previously received. If you have any questions, reach out to your mortgage broker.

Obtain an Appraisal

In order to fully understand the condition of a home, you need to have it inspected. This can also offer you some leverage in negotiating a lower purchase price, or stipulate that certain repairs be performed before you agree to purchase the home.

Get commitments in writing!

If a seller promises to repair a leaking roof or leave behind shiny new appliances, be sure to get this in writing in any agreements you sign. The seller is not obligated to abide by any agreements not stipulated in the contract. This also includes all of the details of your loan.

Set Your Closing Details

If there are any co-applicants, bring them with you, and your realtor if you feel like you could use the support. Typically a notary will be in attendance. Be prepared to do the following:

- Review the final documents. Make sure the rates and amounts are what you agreed to.

- Bring a cashier's check to cover the closing costs and down payment.

- Sign the loan documents and be prepared to show your photo ID. (You may also need to show your Social Security card).

If you currently have an apartment, condo, or house lease:

Consider scheduling your closing date to coincide with the time your lease ends, depending on your needs. You may prefer not to have any overlap so that you can avoid paying rent and mortgage in the same time period, or you may want to have more time in your leased property so that you can complete home improvement projects before you move into your new home.

Now You Own a Home!

Congratulations! You're now a homeowner and are ready to move on to a new chapter of your life. Remember that Great Northern Mortgage is always available to help you, even after you've closed on your new home. If you ever wish to refinance, use your home equity or even invest in additional properties, we're ready to serve you any time.

Additional Resources

The guide provided above should give you a firm grasp of the home buying process. Below, find more resources to help you understand home ownership and the mortgage loan process.

A primer on the benefits of home ownership over renting.

A list of terms you will encounter when discussing mortgages and the home buying process.

Some of the most commonly-asked questions from our clients.

Advice for First-Time Homebuyers

If it's your first time buying a home, don't miss these tips!

Down payment requirements can vary greatly, learn more here.

Learn about potential tax advantages associated with homeownership.

Where to Start?

You think you're ready to buy a home, but you need some help figuring out what kind of loan you need? Below you will find a list of needs commonly held by potential borrowers. Choose the one that sounds the most like what you need as a starting point to doing some research.

- I want stable monthly payments and rate. If you want to be able to account for a loan payment that won't change when you're budgeting, you may be most interested in a fixed-rate mortgage. With a fixed-rate mortgage, you know what your monthly payment will be throughout the life of the loan. Learn more about Fixed Rate Mortgages.

- I want a low interest rate, and I think rates will stay low while I own this property. If you're looking for a low interest rate, or you predict you may resell this property before very long, an adjustable-rate mortgage may be right for you. Learn more about Adjustable Rate Mortgages.

- I'm looking for a property that needs renovation. If you're willing to take on a fixer-upper in order to get the home you're looking for, an FHA 203(k) loan might be right for you because it combines a home loan along with financing for qualified home improvements in a single payment. Learn more about FHA 203k Home Loans

- I'm planning to buy a luxury/high-value home. More expensive homes often require loans that exceed the limits of conventional home loans. Jumbo mortgages can provide the loan amount you require in this situation. Learn more about Jumbo Mortgages

- I am a Veteran. Veterans qualify for VA home loans insured by the U.S. Department of Veteran Affairs. VA home loans can provide you with very favorable home loan terms. You do not have to be a first-time home buyer to use this benefit, and it can be used more than once. Learn more about VA Home Loans

- I need a low down payment. An FHA home loan, insured by the Federal Housing Administration, can help first-time home buyers who may need a co-signer on their loan or have credit problems purchase a home with a down payment as low as 3.5%. Learn more about FHA Home Loans

- I want a home in a rural area. A USDA rural home loan can provide the benefits of flexible credit and a low down payment requirement, along with the security of a fixed rate. Learn more about Down Payments and Loan Types

- I show low income. A Non-QM loan, or a non-qualified mortgage, is a type of mortgage loan that allows you to qualify based on alternative methods, instead of the traditional income verification required for most loans. Common examples include Bank Statements, using your assets as income, no income no assets loans, DSCR Investor loans, Foreign National, ITIN, Vesting Title in Entities - LLCs, Corporations, trusts, partnerships. Learn more about Non-QM Loans

- I need to close fast with no income verification. Hard Money / Bridge Loan financing for residential investment properties is a short-term, bridge loan secured by real estate and traditionally used until permanent financing is put in place. An excellent alternative to conventional bank loans, a bridge loan can be an ideal solution for time-sensitive transactions. Learn more about Specialty Loans

- I am 62 or older and I am interested in reverse mortgage. A reverse mortgage (HECM) allows you to borrow against the equity you have established in your home. To be eligible, you must be age 62 or older and own your home free and clear or have a remaining mortgage balance that can be paid off by the reverse mortgage. You can also purchase a new principal residence using loan proceeds from the reverse mortgage. Learn more about Home Equity Conversion Mortgages

Video Library

Video Library

Resource Center

Resource Center

Why Choose Us?

Why Choose Us?

Careers

Careers

Open a Branch

Open a Branch